The race for market dominance in China’s electric vehicle (EV) sector is hotter than ever, and a recent report from Yiche Ranking throws a spotlight on the brands truly hitting their stride. It seems only a select few manufacturers have managed to navigate the fierce competition and production hurdles to meet their ambitious 2025 sales targets. Leading the pack are Xpeng, Leapmotor, and Xiaomi Auto, showcasing that even amid a rapidly expanding market, some players are pulling ahead with impressive momentum.

Xpeng’s Early Victory Lap

Xpeng isn’t just meeting its goals, it’s absolutely smashing them. With two months still left in the year, the automaker has already surpassed its 2025 sales target. They aimed for 350,000 units and, by the close of October, had already chalked up 355,209 sales. That’s a remarkable 101.5% completion rate, making Xpeng the sole domestic brand to tick off its annual target way ahead of schedule. It’s a testament to their strong product lineup and strategic execution in a cutthroat market.

Leapmotor Leaps Ahead, Xiaomi Auto Close Behind

Not far behind is Leapmotor, securing the second spot in target completion. They set a lofty goal of 500,000 sales for 2025 and have already moved 465,805 units by October, hitting an impressive 93.2% completion rate. We saw Leapmotor break its monthly sales record in October, selling over 70,000 vehicles, solidifying its position as a top-selling NEV brand for the year.

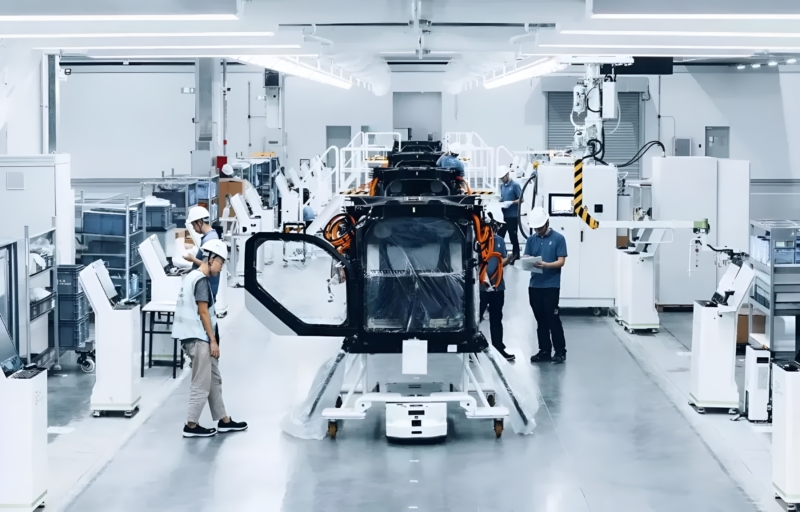

Then there’s Xiaomi Auto. Though a newer entrant, their performance is nothing short of extraordinary. With a target of 350,000 units, they’ve already delivered 306,184 vehicles, achieving an 87.5% completion rate. What makes Xiaomi Auto’s achievement even more compelling is that they’re managing this despite a significant backlog of orders, mainly due to existing production capacity limitations. Currently, their monthly deliveries hover around 40,000 units, but with anticipated production increases, we can expect a substantial boost in their monthly sales figures. Talk about demand outstripping supply. The brand has already seen its EVs flying off the shelves.

The Rest of the Field: A Uphill Battle

While the top three bask in their success, many other brands are finding the going tough. Brands ranked from fourth to twelfth are considerably off pace, with none having hit the crucial 83.3% sales target threshold by October. It’s looking highly unlikely that they’ll achieve their full-year sales objectives. Among them, IM Motors, Voyah, and Nio, despite facing challenges in meeting their overall targets, have still managed to launch several popular models this year and have shown substantial growth in sales volume.

This snapshot of China’s EV market paints a clear picture: while overall growth is undeniable, only those with robust strategies, agile production, and compelling products are truly capturing the market’s potential. The final two months of 2025 will certainly be interesting, as these brands push to close the gap or cement their leading positions.