The new Zeekr 9X is stirring up a frenzy in China’s electric vehicle market, but not just because of its impressive specs. Demand for this full-size plug-in hybrid SUV is so high that scalpers are flipping preorder spots for as much as 120,000 yuan (about $17,000) on Xianyu, a popular second-hand trading platform. With an official starting price of 465,900 yuan (around $66,000), these markups represent a premium of 10 to 26 percent, a clear sign of the vehicle’s desirability.

| Metric | Value | Unit | Notes |

|---|---|---|---|

| 0–100 km/h (0–62 mph) | ~3.1 | s | Hyper trim |

| Peak power | 1,030 | kW | Approx. 1,381 hp (Hyper trim) |

| Range (CLTC) | 1,250 | km | Combined range |

| Battery capacity | 55 / 70 | kWh | Depending on trim |

| System Architecture | 900-volt | PHEV | Plug-in hybrid system |

| Starting price (local market) | ¥465,900 | CNY | Approx. $66,000 USD |

What’s Fueling the Hype?

The Zeekr 9X isn’t just another SUV. It’s a high-performance PHEV built on a cutting-edge 900-volt architecture, which allows for faster charging and better efficiency. The Hyper trim, in particular, is a monster on paper, boasting 1,030 kW (roughly 1,381 hp). That’s enough power to launch the full-size SUV from 0 to 100 km/h in a blistering 3.1 seconds. Combined with a CLTC range of up to 1,250 km from its 55 kWh or 70 kWh battery options, it’s easy to see why buyers are lining up.

A Widespread Issue in China’s EV Market

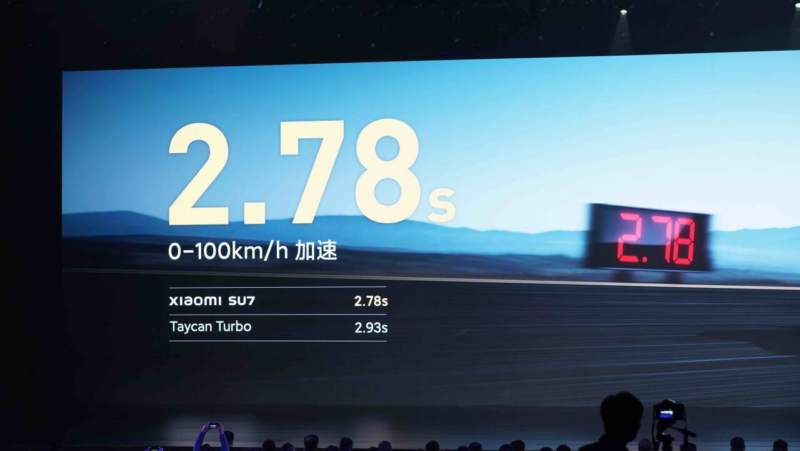

This scalping phenomenon isn’t unique to the 9X. It’s a recurring theme in China’s red-hot EV scene. Other highly anticipated models, like the Xiaomi SU7, Aito M9, and Li Auto Mega, have seen similar activity. Eager buyers, unwilling to face long waits, pay a premium to jump the queue, while early reservation holders cash in on the demand.

The Waiting Game

Early buyers of the Zeekr 9X were quoted delivery times of 9 to 11 weeks. However, the wait has ballooned for new orders, now stretching from 11 to 26 weeks. This has left many customers who ordered months ago still waiting for their vehicles, leading to widespread complaints. The scalped orders often promise immediate or near-immediate delivery, a tempting offer for those with enough cash.

From Domestic Demand to Export

The resale market isn’t just domestic. Some of these preorder units are being exported through Chinese ports like Horgos and Tianjin. Overseas buyers are reportedly paying markups between 50,000 and 100,000 yuan ($7,100 to $14,200) to get their hands on the 9X. This happens despite formal restrictions on order transfers, highlighting the difficulty in policing such a gray market.

Industry analysts see the current situation as a temporary imbalance. The high premiums reflect strong initial demand clashing with limited early production capacity from Zeekr, a brand under the Geely umbrella. As manufacturing ramps up and delivery times shorten, the price gap between official orders and resale listings should shrink. For now, the Zeekr 9X remains a prime example of how hype and scarcity can create a lucrative side market in the competitive world of electric vehicles.