The electric vehicle market in China is always a fast-moving target, and it seems a new challenge is emerging for EV manufacturers. The crucial lithium-ion battery supply chain is seeing some serious cost pressure, with major separator producers signaling price hikes up to 30%. This could definitely shake up EV battery costs in the next few months.

Several big players in the separator game have sent out notices about these price increases, specifically targeting wet-process separator products. Reports from NBD, China’s Daily Economic News, highlight that at least one leading company is looking at a 30% jump for their wet-process separators. Shanghai Securities Journal backs this up, suggesting both base film and coated film wet-process separators could see similar increases. Some adjustments have already started for certain customers, but the full market impact is still unfolding.

Why are Separators Such a Big Deal?

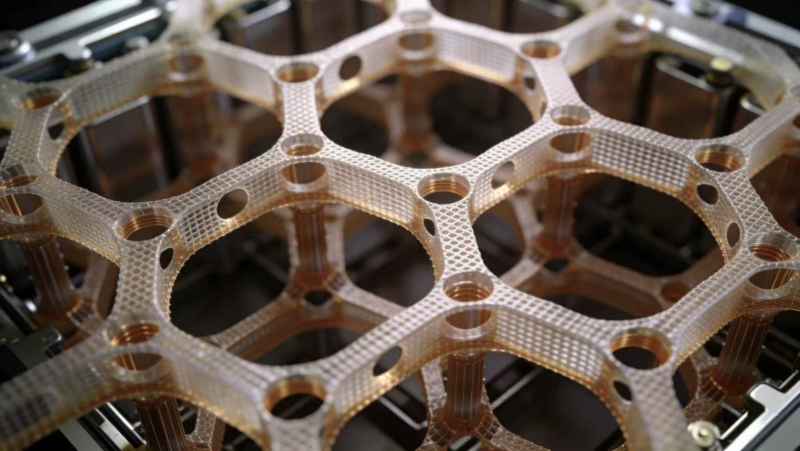

Separators are the unsung heroes of lithium-ion batteries. They act as a critical barrier, carefully keeping the anode and cathode apart while still letting those precious lithium ions flow freely. Think of them as the bouncer at an exclusive club, ensuring the right elements get where they need to go without any unwanted mingling. They typically make up about 10-15% of a battery cell’s cost. So, a 30% hike in separator prices could translate to a 3-5% increase in the overall battery cell cost, assuming manufacturers pass it all on. EVs that use wet-process separators, often those with higher energy density, are likely to feel the pinch most acutely.

Consolidation and Market Dynamics

Industry consolidation is playing a role here, too. A major manufacturer recently snapped up another firm to boost its production of 5-micron separators and related gear. BatteryNet reports that the wet-process separator segment has been running at high capacity, which hints at stable or rising prices thanks to strong demand. With leading firms tightening their grip on the market, smaller battery producers might find their supply options becoming a bit more restricted.

Other Battery Material Prices Remain Steady

It is not all doom and gloom across the board for battery materials. Prices for lithium iron phosphate and nickel-cobalt-lithium ternary cathode materials have stayed pretty stable. Lithium carbonate even saw a slight dip, settling around 90,000-93,000 yuan per tonne, which is roughly 12,700-13,100 USD. Anode materials have maintained full output despite the higher costs of petroleum coke, and electrolyte prices have only nudged up a bit due to cost pressures in six-fluorine precursor chemicals.

The Road Ahead for EV Battery Costs

Analysts are keeping a close eye on the situation, suggesting EV battery prices could face moderate upward pressure in the coming months. While manufacturers and OEMs might absorb some of these initial cost increases, a sustained rise in separator prices could definitely impact overall EV battery costs, especially for those high-performance models using energy-dense cells. This is China’s EV market after all, so brace yourself for constant evolution and adaptation. It is a thrilling ride, even with the occasional price bump! Battery production is complex, and this is just another twist in the tale.